Cost of Goods Sold Calculator

Calculate cost of goods sold using inventory and purchases data.

What is Cost of Goods Sold?

Cost of Goods Sold (COGS) is the direct costs attributable to the production of the goods sold by a company.

COGS is calculated by adding beginning inventory to purchases and subtracting ending inventory. This shows costs of producing sold goods.

COGS is crucial for businesses, impacting gross profit and profitability. Lower COGS indicates higher profitability; higher COGS can signal inefficiencies.

COGS is important for inventory management and financial reporting, helping assess production efficiency, pricing, and inventory levels.

COGS is a key indicator of a company’s operational performance and financial health.

Cost of Goods Sold Formula

Cost of Goods Sold Calculation Examples

Example 1

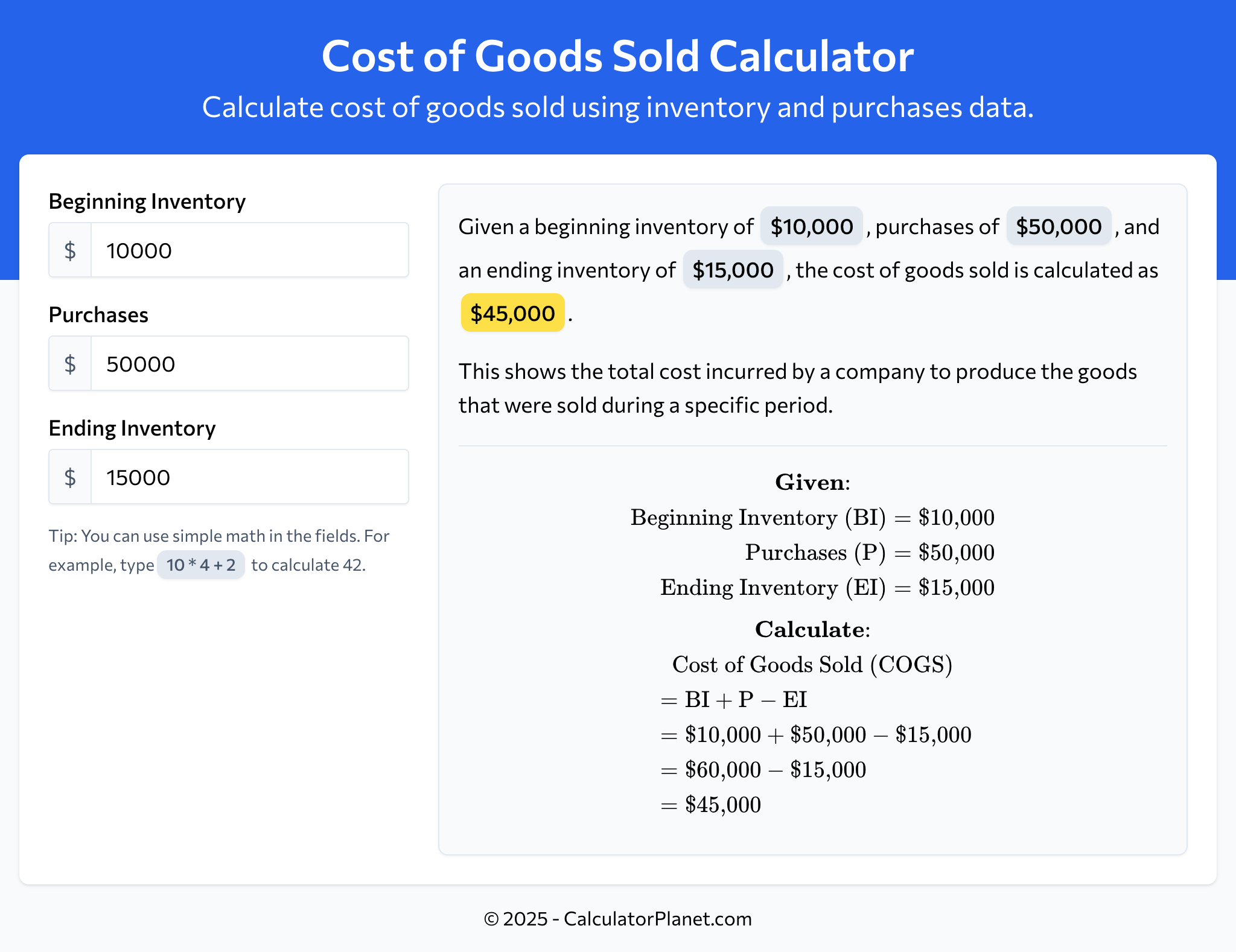

A retail store starts the year with a beginning inventory of $10,000. During the year, they purchase additional stock worth $50,000. At the end of the year, their ending inventory is valued at $15,000.

Let's calculate the cost of goods sold for the year:

This indicates that the cost of goods sold for the retail store during the year is $45,000.

Example 2

A manufacturer begins the year with a beginning inventory of $20,000. Throughout the year, they acquire more materials worth $30,000. By the end of the year, their ending inventory is $10,000.

Let's calculate the cost of goods sold for this manufacturer:

This calculation shows that the cost of goods sold for the manufacturer is $40,000.

Reference This Page

If you found our Cost of Goods Sold Calculator valuable, please consider referencing this page in your work. You can easily cite it by using the following formatted text:

More Calculators

- Annualized Return Calculator

- Break-Even Point Calculator

- Buying Power Calculator

- Compound Annual Growth Rate (CAGR) Calculator

- Cost of Goods Sold Calculator

- Current Ratio Calculator

- Debt to Equity Ratio Calculator

- Dividend Yield Calculator

- Earnings Per Share (EPS) Calculator

- Free Cash Flow (FCF) Calculator

- Future Value Calculator

- Gross Margin Calculator

- Marginal Revenue Calculator

- Markup Calculator

- Net Present Value (NPV) Calculator

- Operating Leverage Calculator

- Operating Margin Calculator

- Payback Period Calculator

- Present Value Calculator

- Price-to-Earnings Ratio (P/E) Calculator

- Profit Margin Calculator

- Return on Assets (ROA) Calculator

- Return on Equity (ROE) Calculator

- Return on Investment (ROI) Calculator

- Revenue Growth Calculator

- Total Revenue Calculator

- Variable Cost Ratio Calculator

- Working Capital Calculator