Gross Margin Calculator

Calculate the percentage of revenue remaining after deducting cost of goods sold.

What is Gross Margin?

Gross Margin is the percentage of revenue that remains after subtracting the cost of goods sold (COGS).

Gross Margin is calculated by dividing gross profit (revenue minus COGS) by revenue, then multiplying by 100 to express as a percentage.

Understanding Gross Margin helps businesses assess pricing strategies and operational efficiency in producing goods or services.

A higher gross margin indicates better profitability and more funds available for operating expenses, marketing, and growth investments.

Gross margins vary significantly by industry, with software and services typically having higher margins than manufacturing or retail.

Monitoring gross margin trends helps identify cost inflation, pricing pressure, or operational improvements over time.

While important, gross margin doesn’t account for operating expenses, so it should be analyzed alongside other profitability metrics.

Gross Margin Formula

Gross Margin Calculation Examples

Example 1

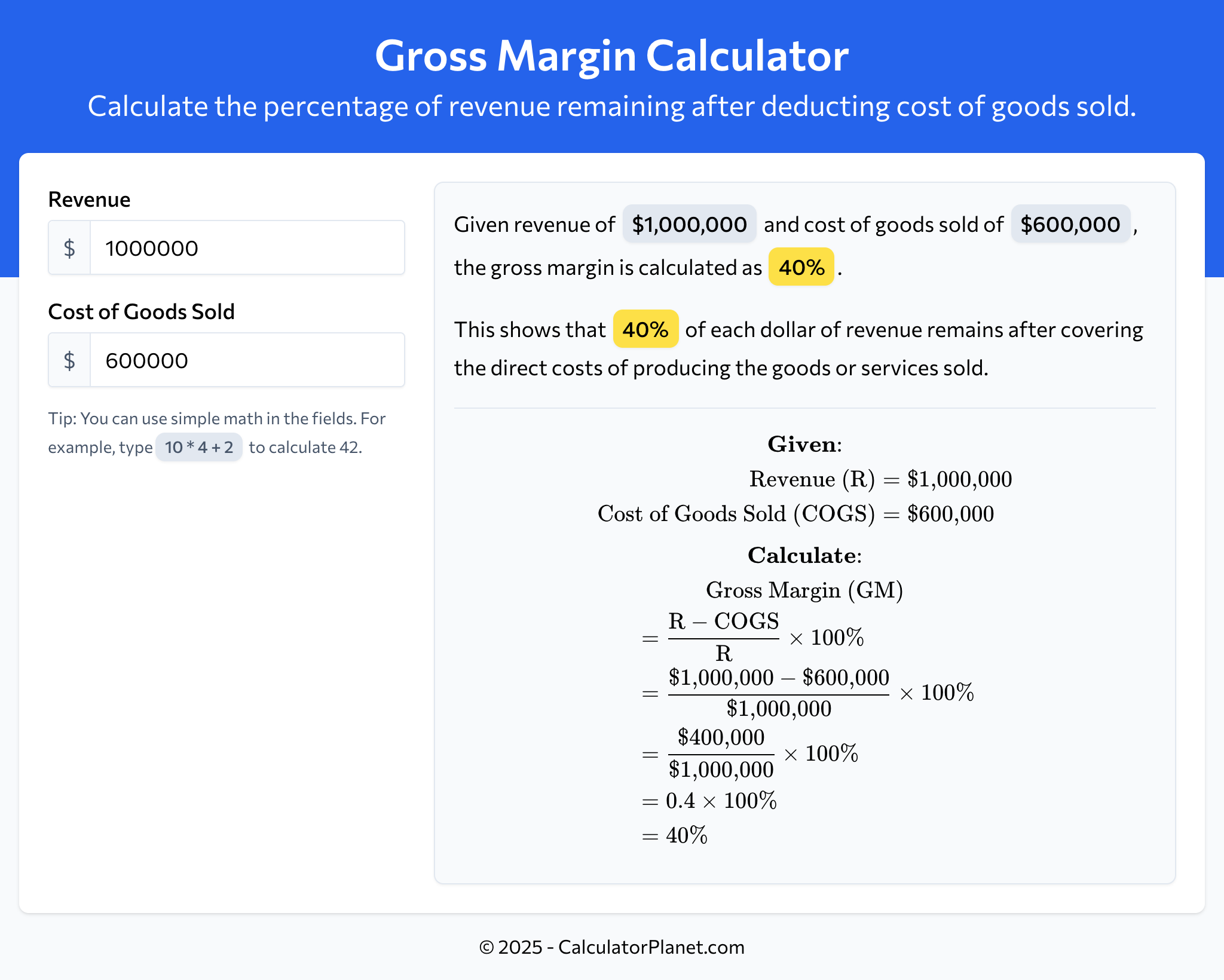

A software company generated revenue of $1,000,000 last year. Their cost of goods sold, including server costs, third-party licenses, and direct support staff, totaled $600,000.

To calculate their gross margin:

The gross margin of 40% indicates that for every dollar of revenue, the company retains 40 cents after covering direct costs.

This healthy margin is typical for software companies and provides substantial funds for operating expenses, marketing, and profit.

Example 2

A restaurant chain reports annual revenue of $500,000 with cost of goods sold of $350,000, which includes food ingredients, beverages, and packaging materials.

Let's determine their gross margin:

The gross margin of 30% shows that the restaurant retains 30 cents from each dollar of sales after paying for food and beverage costs.

This margin must cover labor, rent, utilities, and other operating expenses, making efficient cost management crucial for profitability.

Reference This Page

If you found our Gross Margin Calculator valuable, please consider referencing this page in your work. You can easily cite it by using the following formatted text:

More Calculators

- Annualized Return Calculator

- Break-Even Point Calculator

- Buying Power Calculator

- Compound Annual Growth Rate (CAGR) Calculator

- Cost of Goods Sold Calculator

- Current Ratio Calculator

- Debt to Equity Ratio Calculator

- Dividend Yield Calculator

- Earnings Per Share (EPS) Calculator

- Free Cash Flow (FCF) Calculator

- Future Value Calculator

- Gross Margin Calculator

- Marginal Revenue Calculator

- Markup Calculator

- Net Present Value (NPV) Calculator

- Operating Leverage Calculator

- Operating Margin Calculator

- Payback Period Calculator

- Present Value Calculator

- Price-to-Earnings Ratio (P/E) Calculator

- Profit Margin Calculator

- Return on Assets (ROA) Calculator

- Return on Equity (ROE) Calculator

- Return on Investment (ROI) Calculator

- Revenue Growth Calculator

- Total Revenue Calculator

- Variable Cost Ratio Calculator

- Working Capital Calculator