Present Value Calculator

Calculate the present value of future cash flows discounted at a specific rate.

What is Present Value?

Present Value (PV) is the current worth of a future sum of money, discounted at a specific rate to account for the time value of money.

Present Value is calculated by dividing the future value by (1 + discount rate)^time period, which adjusts for the earning potential of money over time.

Understanding Present Value is crucial for financial decision-making, as it allows comparison of cash flows occurring at different times.

The concept recognizes that money available today is worth more than the same amount in the future due to its earning potential.

Present Value calculations help investors evaluate investment opportunities, determine fair prices for financial instruments, and make capital allocation decisions.

The discount rate used in Present Value calculations typically reflects the opportunity cost of capital or the required rate of return.

Present Value is fundamental to many financial concepts, including Net Present Value (NPV), bond pricing, and valuation models.

Present Value Formula

Present Value Calculation Examples

Example 1

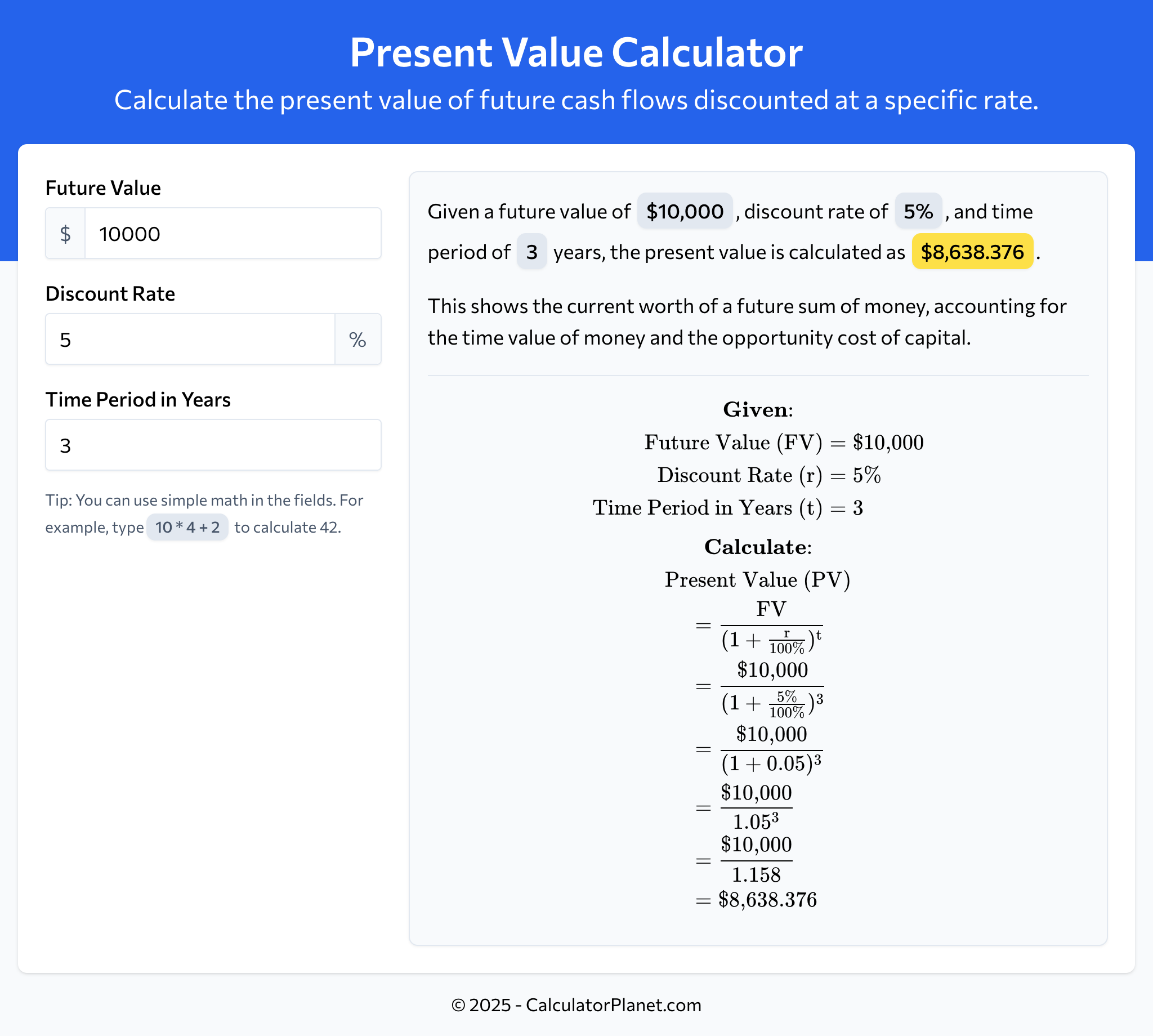

An investor expects to receive $10,000 in 3 years. With a discount rate of 5% reflecting the opportunity cost of capital, what is this future payment worth today?

To calculate the present value:

The present value is $8,638.376, meaning that receiving $10,000 in 3 years is equivalent to having $8,638.376 today when discounted at 5%.

This demonstrates that due to the time value of money, future cash flows are worth less in today's dollars.

Example 2

A company expects to receive $50,000 from a long-term contract in 10 years. The company's cost of capital is 8%, used as the discount rate.

Let's calculate the present value of this future cash flow:

The present value is $23,159.674, indicating that the future payment of $50,000 in 10 years is worth $23,159.674 in today's dollars when discounted at 8%.

This present value helps the company evaluate whether the contract terms are financially attractive compared to alternative investments.

Reference This Page

If you found our Present Value Calculator valuable, please consider referencing this page in your work. You can easily cite it by using the following formatted text:

More Calculators

- Annualized Return Calculator

- Break-Even Point Calculator

- Buying Power Calculator

- Compound Annual Growth Rate (CAGR) Calculator

- Cost of Goods Sold Calculator

- Current Ratio Calculator

- Debt to Equity Ratio Calculator

- Dividend Yield Calculator

- Earnings Per Share (EPS) Calculator

- Free Cash Flow (FCF) Calculator

- Future Value Calculator

- Gross Margin Calculator

- Marginal Revenue Calculator

- Markup Calculator

- Net Present Value (NPV) Calculator

- Operating Leverage Calculator

- Operating Margin Calculator

- Payback Period Calculator

- Present Value Calculator

- Price-to-Earnings Ratio (P/E) Calculator

- Profit Margin Calculator

- Return on Assets (ROA) Calculator

- Return on Equity (ROE) Calculator

- Return on Investment (ROI) Calculator

- Revenue Growth Calculator

- Total Revenue Calculator

- Variable Cost Ratio Calculator

- Working Capital Calculator