Current Ratio Calculator

Calculate a company's ability to pay short-term obligations with current assets.

What is Current Ratio?

Current Ratio is a liquidity ratio that measures a company’s ability to pay short-term obligations using current assets.

Current Ratio is calculated by dividing current assets by current liabilities, providing insight into short-term financial health.

Understanding Current Ratio helps investors and creditors assess whether a company can meet its immediate financial obligations.

A current ratio above 1.0 generally indicates good liquidity, while ratios below 1.0 may signal potential cash flow problems.

However, optimal current ratios vary by industry, with some businesses operating successfully with lower ratios due to predictable cash flows.

Too high a current ratio might indicate inefficient use of assets, as excess cash could be invested in growth opportunities.

Current Ratio analysis should be combined with other financial metrics and industry benchmarks for comprehensive evaluation.

Current Ratio Formula

Current Ratio Calculation Examples

Example 1

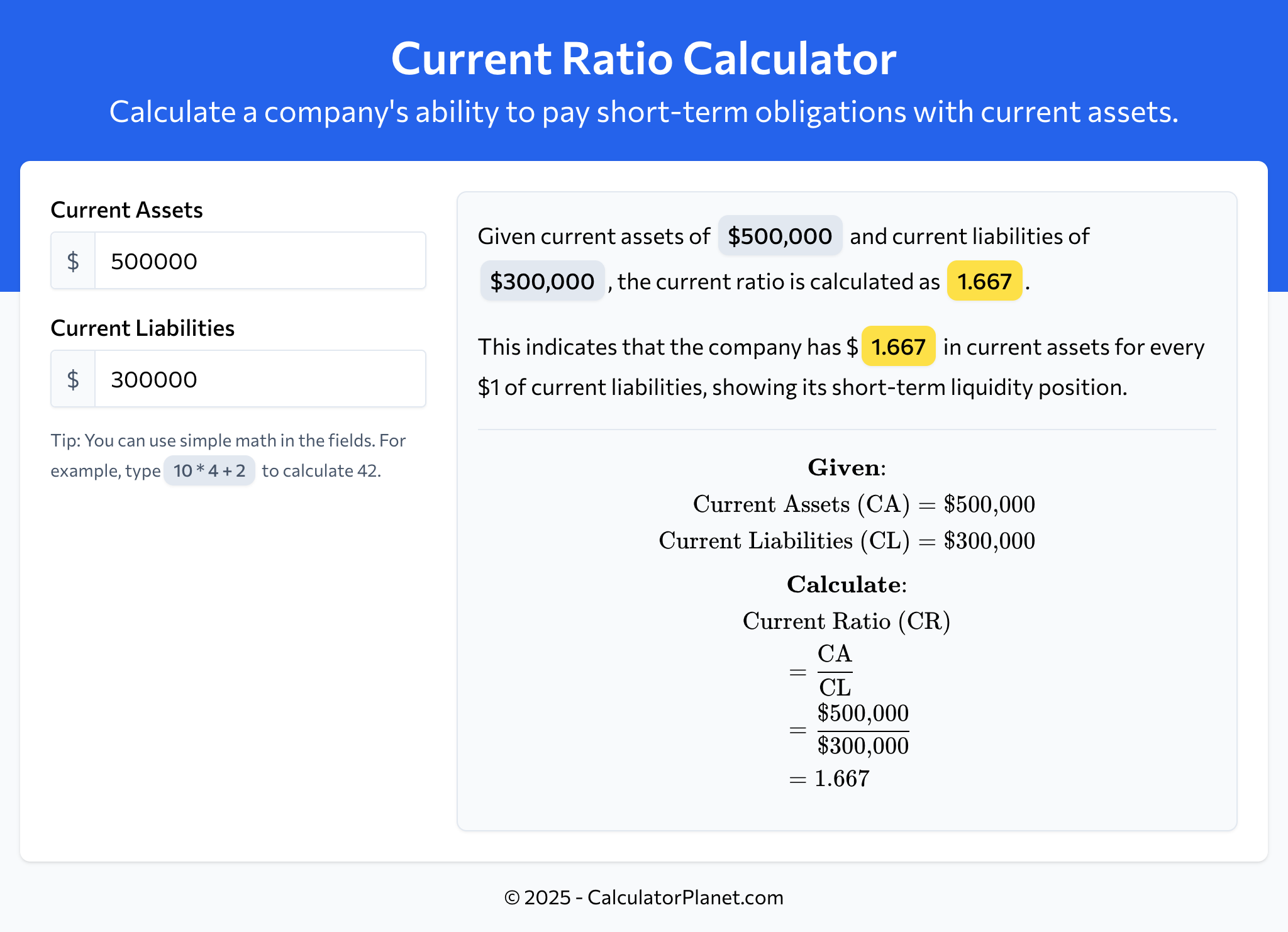

A retail company has current assets of $500,000, including cash, inventory, and accounts receivable. Their current liabilities total $300,000, consisting of accounts payable, short-term loans, and accrued expenses.

To assess the company's short-term liquidity:

The current ratio of 1.667 indicates that the company has $1.667 in current assets for every $1 of current liabilities.

This ratio above 1.0 suggests the company can meet its short-term obligations, though the ideal ratio varies by industry. Retailers typically maintain higher ratios due to inventory requirements.

Example 2

A manufacturing company reports current assets of $800,000 and current liabilities of $1,000,000. The company is concerned about its ability to meet upcoming debt payments and supplier obligations.

Let's calculate their current ratio:

The current ratio of 0.8 indicates potential liquidity concerns, as the company has only $0.8 in current assets for every $1 of current liabilities.

A ratio below 1.0 suggests the company may struggle to meet short-term obligations without converting long-term assets to cash or securing additional financing.

Reference This Page

If you found our Current Ratio Calculator valuable, please consider referencing this page in your work. You can easily cite it by using the following formatted text:

More Calculators

- Annualized Return Calculator

- Break-Even Point Calculator

- Buying Power Calculator

- Compound Annual Growth Rate (CAGR) Calculator

- Cost of Goods Sold Calculator

- Current Ratio Calculator

- Debt to Equity Ratio Calculator

- Dividend Yield Calculator

- Earnings Per Share (EPS) Calculator

- Free Cash Flow (FCF) Calculator

- Future Value Calculator

- Gross Margin Calculator

- Marginal Revenue Calculator

- Markup Calculator

- Net Present Value (NPV) Calculator

- Operating Leverage Calculator

- Operating Margin Calculator

- Payback Period Calculator

- Present Value Calculator

- Price-to-Earnings Ratio (P/E) Calculator

- Profit Margin Calculator

- Return on Assets (ROA) Calculator

- Return on Equity (ROE) Calculator

- Return on Investment (ROI) Calculator

- Revenue Growth Calculator

- Total Revenue Calculator

- Variable Cost Ratio Calculator

- Working Capital Calculator