Working Capital Calculator

Calculate the difference between current assets and current liabilities.

What is Working Capital?

Working Capital is the difference between a company’s current assets and current liabilities, measuring short-term financial health.

Working Capital is calculated by subtracting current liabilities from current assets, showing the net amount available for operations.

Understanding Working Capital helps assess a company’s ability to fund daily operations and short-term obligations without external financing.

Positive working capital indicates good liquidity, while negative working capital may signal potential cash flow problems.

Working capital needs vary by industry and business model, with some companies operating successfully with minimal or negative working capital.

Effective working capital management involves optimizing inventory levels, collection periods, and payment terms with suppliers.

Monitoring working capital trends helps identify seasonal patterns, growth funding needs, and operational efficiency improvements.

Working Capital Formula

Working Capital Calculation Examples

Example 1

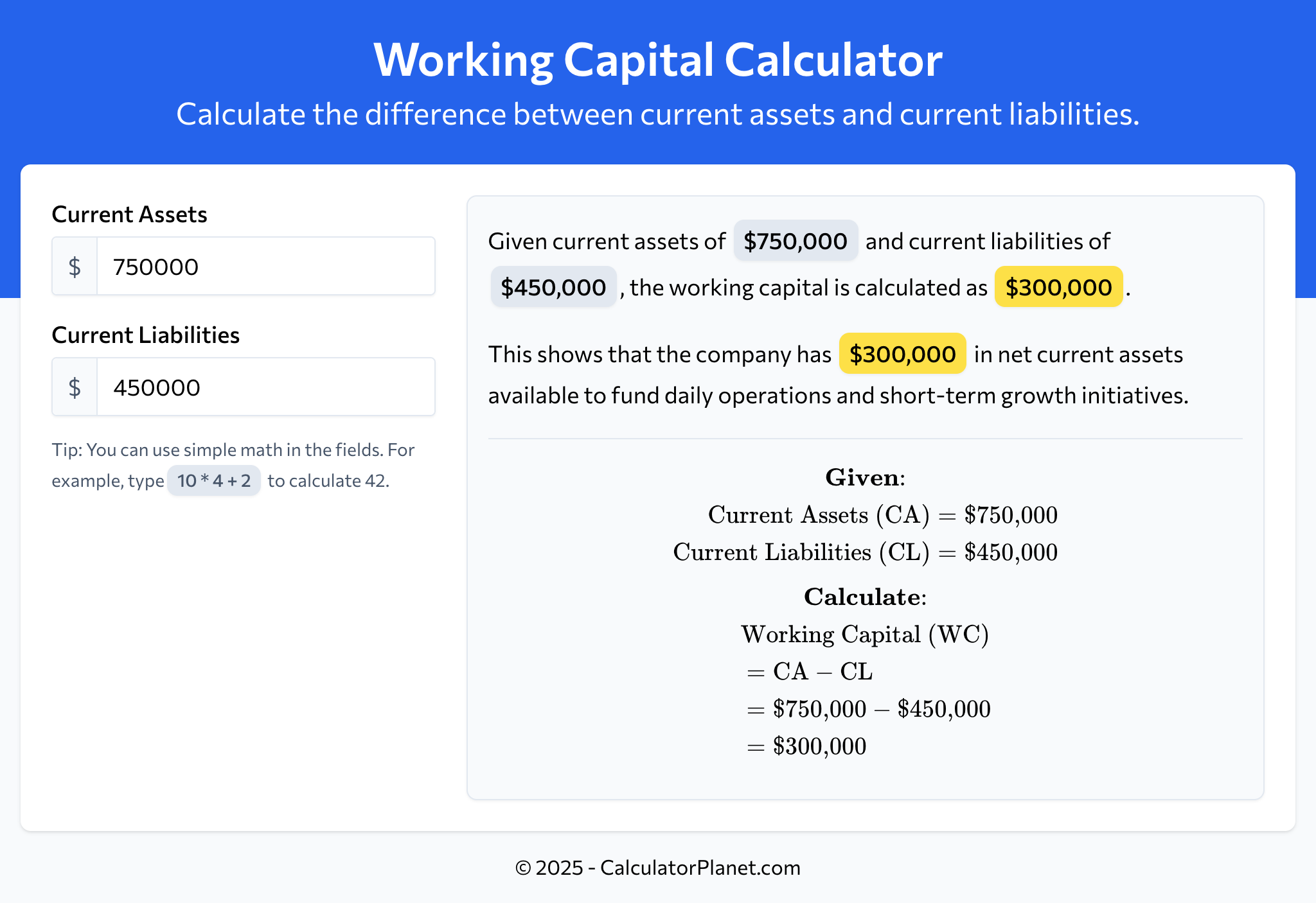

A technology startup has current assets of $750,000, including cash, accounts receivable, and inventory. Their current liabilities total $450,000, consisting of accounts payable, accrued expenses, and short-term debt.

To calculate their working capital:

The working capital of $300,000 indicates the company has substantial liquidity to fund operations and pursue growth opportunities.

This positive working capital provides a financial cushion and flexibility to handle unexpected expenses or invest in new projects without immediate financing needs.

Example 2

A retail business reports current assets of $300,000 and current liabilities of $400,000. The company is evaluating its short-term financial position and ability to expand operations.

Let's determine their working capital:

The negative working capital of -$100,000 indicates potential liquidity challenges, as current liabilities exceed current assets.

This situation requires careful cash flow management and may limit the company's ability to invest in growth without securing additional financing or improving collection processes.

Reference This Page

If you found our Working Capital Calculator valuable, please consider referencing this page in your work. You can easily cite it by using the following formatted text:

More Calculators

- Annualized Return Calculator

- Break-Even Point Calculator

- Buying Power Calculator

- Compound Annual Growth Rate (CAGR) Calculator

- Cost of Goods Sold Calculator

- Current Ratio Calculator

- Debt to Equity Ratio Calculator

- Dividend Yield Calculator

- Earnings Per Share (EPS) Calculator

- Free Cash Flow (FCF) Calculator

- Future Value Calculator

- Gross Margin Calculator

- Marginal Revenue Calculator

- Markup Calculator

- Net Present Value (NPV) Calculator

- Operating Leverage Calculator

- Operating Margin Calculator

- Payback Period Calculator

- Present Value Calculator

- Price-to-Earnings Ratio (P/E) Calculator

- Profit Margin Calculator

- Return on Assets (ROA) Calculator

- Return on Equity (ROE) Calculator

- Return on Investment (ROI) Calculator

- Revenue Growth Calculator

- Total Revenue Calculator

- Variable Cost Ratio Calculator

- Working Capital Calculator