Break-Even Point Calculator

Calculate the sales volume needed to cover all fixed and variable costs.

What is Break-Even Point?

Break-Even Point is the sales volume at which total revenue equals total costs, resulting in neither profit nor loss.

Break-Even Point is calculated by dividing fixed costs by the contribution margin per unit (selling price minus variable cost per unit).

Understanding Break-Even Point helps businesses determine the minimum sales needed to avoid losses and plan pricing strategies effectively.

It’s a fundamental tool for financial planning, helping entrepreneurs assess business viability and set realistic sales targets.

Break-Even Analysis assumes that fixed costs remain constant and variable costs change proportionally with production volume.

The calculation provides valuable insights for decision-making, including pricing adjustments, cost control measures, and capacity planning.

While useful for planning, Break-Even Point doesn’t account for market demand limitations or competition effects on actual sales volumes.

Break-Even Point Formula

Break-Even Point Calculation Examples

Example 1

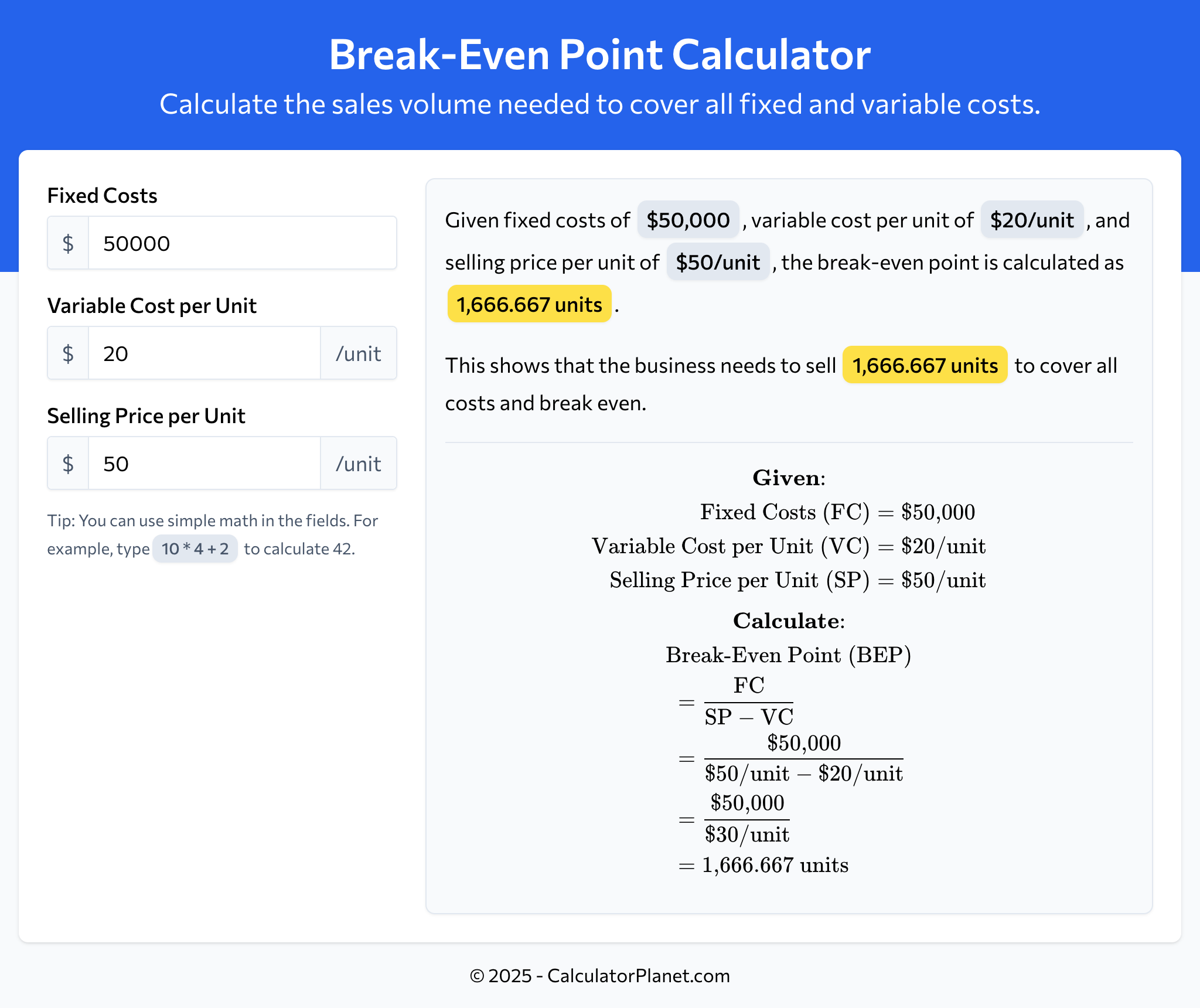

A small bakery has fixed costs of $50,000 per month, including rent, insurance, and salaries. Each cake costs $20/unit to produce (ingredients, packaging) and sells for $50/unit.

To determine how many cakes need to be sold to break even, we calculate:

The bakery needs to sell 1,666.667 units cakes per month to break even.

At this volume, total revenue (1,666.667 units × $50/unit = $83,333.333) equals total costs (fixed costs of $50,000 + variable costs of 1,666.667 units × $20/unit = $33,333.333).

Example 2

A manufacturing company has monthly fixed costs of $120,000 for facilities, equipment, and overhead. Each product costs $15/unit in materials and labor to produce and sells for $35/unit.

To find the break-even sales volume:

The company must sell 6,000 units per month to break even.

Beyond this point, each additional unit sold contributes $20/unit toward profit, as variable costs are covered and fixed costs are already paid.

Reference This Page

If you found our Break-Even Point Calculator valuable, please consider referencing this page in your work. You can easily cite it by using the following formatted text:

More Calculators

- Annualized Return Calculator

- Break-Even Point Calculator

- Buying Power Calculator

- Compound Annual Growth Rate (CAGR) Calculator

- Cost of Goods Sold Calculator

- Current Ratio Calculator

- Debt to Equity Ratio Calculator

- Dividend Yield Calculator

- Earnings Per Share (EPS) Calculator

- Free Cash Flow (FCF) Calculator

- Future Value Calculator

- Gross Margin Calculator

- Marginal Revenue Calculator

- Markup Calculator

- Net Present Value (NPV) Calculator

- Operating Leverage Calculator

- Operating Margin Calculator

- Payback Period Calculator

- Present Value Calculator

- Price-to-Earnings Ratio (P/E) Calculator

- Profit Margin Calculator

- Return on Assets (ROA) Calculator

- Return on Equity (ROE) Calculator

- Return on Investment (ROI) Calculator

- Revenue Growth Calculator

- Total Revenue Calculator

- Variable Cost Ratio Calculator

- Working Capital Calculator