Return on Investment (ROI) Calculator

Calculate the return on investment as a percentage to evaluate investment performance.

What is Return on Investment (ROI)?

Return on Investment (ROI) is a performance measure used to evaluate the efficiency and profitability of an investment.

ROI is calculated by dividing the net profit from an investment by the cost of the investment and expressing it as a percentage.

Understanding ROI helps investors compare the effectiveness of different investments and make informed decisions about where to allocate capital.

A positive ROI indicates that the investment generated profit, while a negative ROI shows a loss on the investment.

ROI is widely used across various investment types, from stocks and bonds to real estate and business ventures.

While ROI is a useful metric, it doesn’t account for the time value of money or investment risk, so it should be used alongside other financial metrics.

ROI calculations assume that all gains and costs are accurately measured and that the investment period is clearly defined.

Return on Investment (ROI) Formula

Return on Investment (ROI) Calculation Examples

Example 1

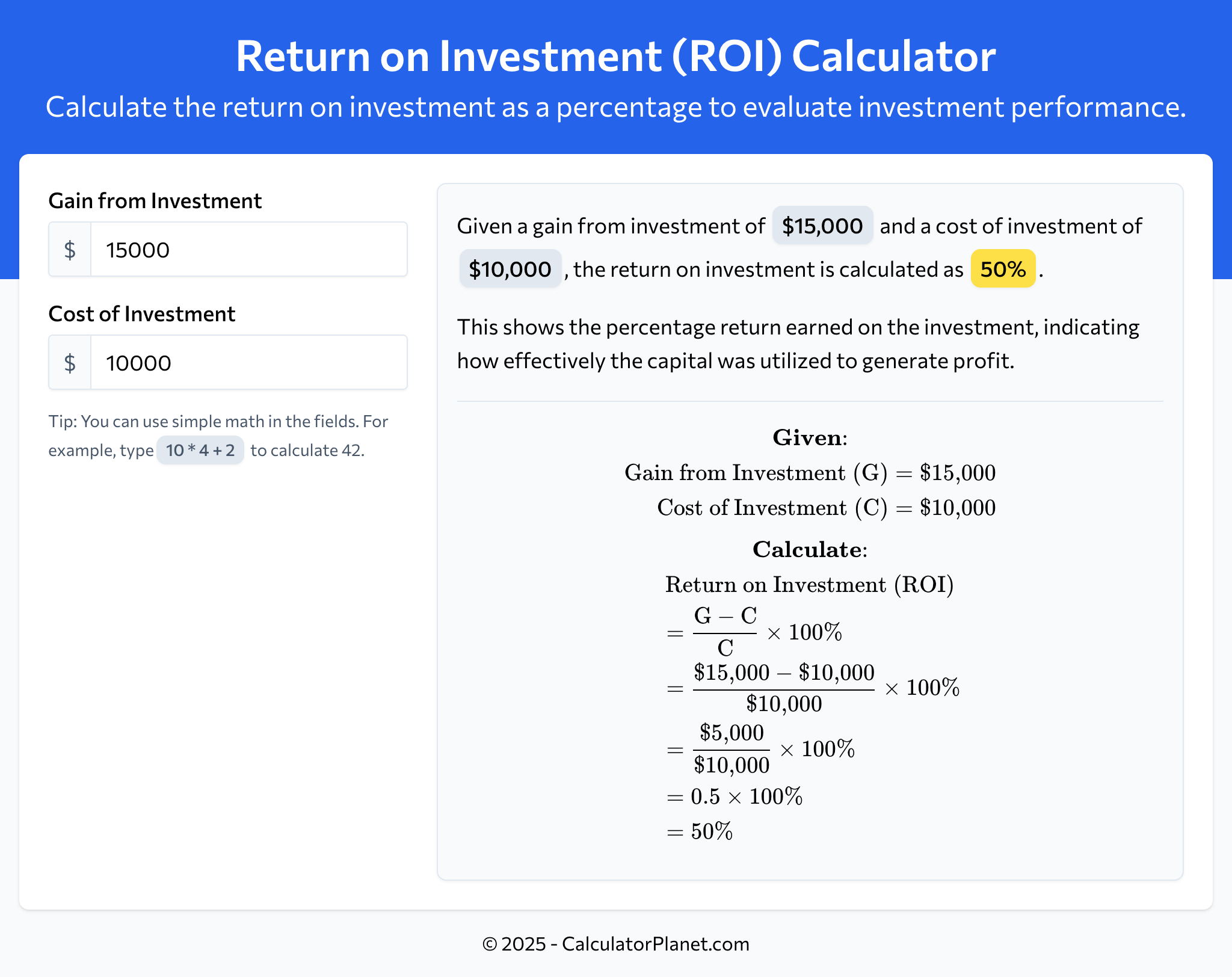

An investor purchases stocks for $10,000 and sells them later for $15,000.

To evaluate the performance of this investment:

The return on investment is 50%, indicating that the investor earned a 50% return on their initial investment.

This means the investor earned $5,000 in profit on their $10,000 investment, making this a profitable investment.

Example 2

A business invests $12,000 in new equipment and generates additional revenue of $8,000 over the equipment's useful life.

Let's calculate the ROI for this capital investment:

The return on investment is -33.333%, indicating a negative return on this investment.

This suggests that the equipment investment did not generate sufficient returns to recover the initial cost, resulting in a loss of -33.333% on the invested capital.

Reference This Page

If you found our Return on Investment (ROI) Calculator valuable, please consider referencing this page in your work. You can easily cite it by using the following formatted text:

More Calculators

- Annualized Return Calculator

- Break-Even Point Calculator

- Buying Power Calculator

- Compound Annual Growth Rate (CAGR) Calculator

- Cost of Goods Sold Calculator

- Current Ratio Calculator

- Debt to Equity Ratio Calculator

- Dividend Yield Calculator

- Earnings Per Share (EPS) Calculator

- Free Cash Flow (FCF) Calculator

- Future Value Calculator

- Gross Margin Calculator

- Marginal Revenue Calculator

- Markup Calculator

- Net Present Value (NPV) Calculator

- Operating Leverage Calculator

- Operating Margin Calculator

- Payback Period Calculator

- Present Value Calculator

- Price-to-Earnings Ratio (P/E) Calculator

- Profit Margin Calculator

- Return on Assets (ROA) Calculator

- Return on Equity (ROE) Calculator

- Return on Investment (ROI) Calculator

- Revenue Growth Calculator

- Total Revenue Calculator

- Variable Cost Ratio Calculator

- Working Capital Calculator